Which of the following are true for a coupon bond – Delving into the realm of fixed-income investments, we embark on an exploration of coupon bonds, unraveling their distinctive features, valuation methods, and associated risks. This comprehensive analysis aims to illuminate the intricacies of coupon bonds, empowering investors with the knowledge to make informed decisions.

Coupon bonds, characterized by their regular interest payments and predetermined maturity dates, offer a unique blend of stability and yield. Their characteristics, including coupon rates and face values, play a pivotal role in determining their value and returns, making a thorough understanding of these factors essential.

1. Definition of Coupon Bond: Which Of The Following Are True For A Coupon Bond

A coupon bond is a type of fixed-income security that pays periodic interest payments, known as coupons, to the bondholder. It differs from other types of bonds, such as zero-coupon bonds, which do not pay regular interest payments. Coupon bonds are typically issued with a specific maturity date, at which point the principal amount is repaid to the bondholder.

2. Characteristics of Coupon Bonds

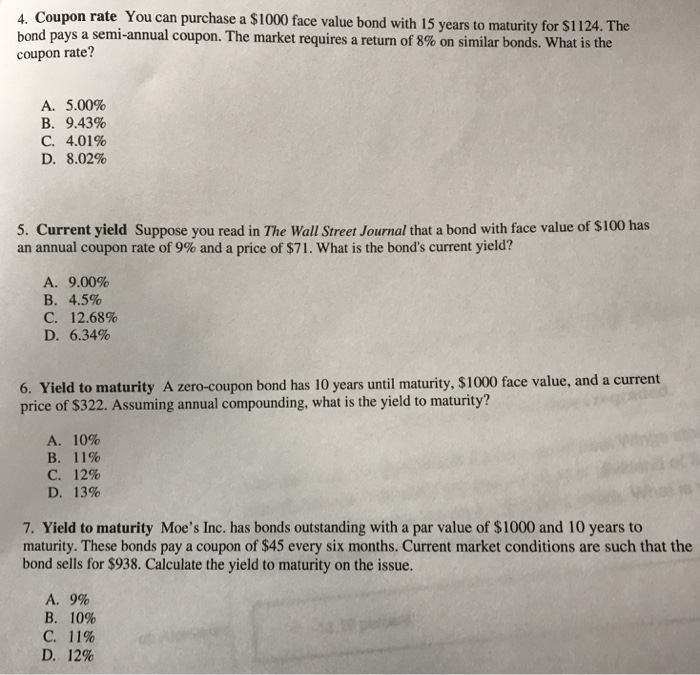

Coupon bonds are characterized by their maturity dates, coupon rates, and face values. The maturity date is the date on which the principal amount is repaid to the bondholder. The coupon rate is the annual interest rate paid on the bond, expressed as a percentage of the face value.

The face value is the principal amount of the bond, which is repaid at maturity.

Factors Affecting Bond Value and Return

The value and return of a coupon bond are affected by several factors, including:

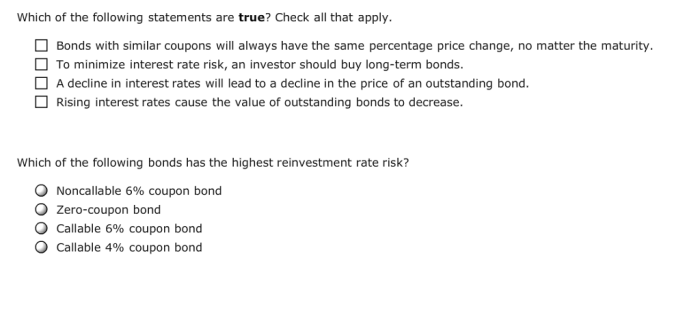

- Interest rates: Rising interest rates can decrease the value of a coupon bond, as investors can earn higher returns on newly issued bonds with higher coupon rates.

- Credit risk: The creditworthiness of the bond issuer can impact the bond’s value. Bonds issued by issuers with higher credit risk may have lower values.

- Maturity: Longer-term bonds typically have higher interest rates than shorter-term bonds, as investors demand a higher return for the increased risk of holding the bond for a longer period.

3. Valuation of Coupon Bonds

Coupon bonds can be valued using different methods, including:

- Present value: The present value of a coupon bond is the sum of the present values of all future cash flows, including both coupon payments and the repayment of principal at maturity.

- Yield to maturity: The yield to maturity (YTM) of a coupon bond is the annual rate of return that an investor would earn if they held the bond until maturity and reinvested all coupon payments at the same rate.

Example of Present Value Calculation

For example, a coupon bond with a face value of $1,000, a coupon rate of 5%, and a maturity of 10 years would have a present value of approximately $822.33, assuming an annual discount rate of 6%.

4. Types of Coupon Bonds

There are various types of coupon bonds available, including:

- Government bonds: Bonds issued by governments, which are considered low-risk investments.

- Corporate bonds: Bonds issued by corporations, which may have higher credit risk than government bonds.

- Municipal bonds: Bonds issued by state and local governments, which may offer tax advantages.

- High-yield bonds: Bonds issued by companies with lower credit ratings, which typically offer higher yields but also carry higher risk.

Advantages and Disadvantages of Each Type

The advantages and disadvantages of each type of coupon bond vary depending on the issuer, credit risk, and tax implications.

5. Risks Associated with Coupon Bonds

Investing in coupon bonds involves several risks, including:

- Interest rate risk: Changes in interest rates can affect the value of coupon bonds, as investors may sell their bonds to purchase newly issued bonds with higher coupon rates.

- Credit risk: The possibility that the bond issuer may default on their obligation to make interest and principal payments.

- Inflation risk: Inflation can erode the value of coupon bond payments, as the purchasing power of the interest and principal payments decreases over time.

Strategies for Mitigating Risks, Which of the following are true for a coupon bond

Strategies for mitigating these risks include:

- Diversification: Investing in a diversified portfolio of bonds with different maturities, credit ratings, and issuers can help reduce risk.

- Investing in bonds with shorter maturities: Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds.

- Investing in bonds with higher credit ratings: Bonds with higher credit ratings have a lower risk of default, which can mitigate credit risk.

6. Comparison of Coupon Bonds with Other Investments

Coupon bonds can be compared with other types of investments, such as:

- Stocks: Stocks represent ownership in a company and offer the potential for higher returns but also carry higher risk than bonds.

- Money market accounts: Money market accounts are low-risk investments that offer a modest return and are highly liquid.

Choosing the Right Investment

The choice of investment depends on individual circumstances, risk tolerance, and financial goals. Coupon bonds may be suitable for investors seeking a balance of risk and return, while stocks may be more appropriate for investors with a higher risk tolerance and a longer investment horizon.

Money market accounts are a good option for investors seeking a low-risk, liquid investment.

Q&A

What differentiates coupon bonds from other types of bonds?

Coupon bonds are distinguished by their regular interest payments, known as coupons, paid at predetermined intervals throughout the bond’s life. In contrast, zero-coupon bonds do not make periodic interest payments, accumulating interest until maturity when they are redeemed at a price above their purchase price.

How does the maturity date impact a coupon bond’s value?

The maturity date determines the length of time until the bond matures and the investor receives the principal amount. Longer maturity dates generally result in higher interest rates to compensate for the extended investment period, potentially leading to higher returns but also greater exposure to interest rate risk.

What are the key factors influencing the valuation of a coupon bond?

Bond valuation considers several factors, including the bond’s coupon rate, maturity date, credit risk of the issuer, and prevailing interest rates. Changes in these factors can significantly impact the bond’s price and yield.