Embarking on a journey into the realm of taxation, the H&R Block Tax Assessment Test Answers serve as an invaluable guide, unlocking the gateway to a successful career in this dynamic field. Delving into the intricacies of the test, this comprehensive analysis unveils the key concepts, effective preparation strategies, and the pivotal role it plays in career advancement.

With meticulous precision, this exploration dissects the test’s format, content, and scoring system, empowering aspiring tax professionals with the knowledge and strategies to excel in this rigorous assessment. Moreover, it illuminates the significance of the test in the job market, showcasing its ability to enhance job applications and interviews, propelling individuals toward their professional aspirations.

Introduction to H&R Block Tax Assessment Test

The H&R Block Tax Assessment Test is an online exam designed to evaluate a candidate’s knowledge and skills in tax preparation. The test is typically taken by individuals who are seeking employment as tax preparers with H&R Block.The test consists of multiple-choice questions covering a wide range of tax topics, including individual income tax, business tax, and estate planning.

The test is timed, and candidates are given a limited amount of time to complete the exam.

Test Format and Structure

The H&R Block Tax Assessment Test is a multiple-choice exam consisting of 50 questions. The test is divided into two sections:

- Section 1:Individual Income Tax (25 questions)

- Section 2:Business Tax and Estate Planning (25 questions)

Candidates are given 60 minutes to complete the exam. The test is scored on a scale of 0 to 100, with a passing score of 70%.

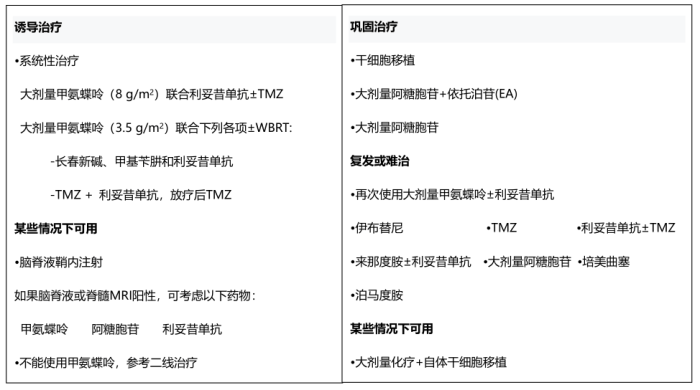

Examining the Test’s Content

The H&R Block Tax Assessment Test comprehensively evaluates candidates’ knowledge and skills in tax-related matters. The test covers a wide range of topics, including:

- Federal and state tax laws and regulations

- Tax preparation and filing procedures

- Tax accounting and auditing

- Tax planning and consulting

The test is designed to assess candidates’ understanding of tax concepts and their ability to apply them to real-world scenarios. The questions vary in difficulty level, from basic to advanced, and cover a wide range of topics.Common question types include:

- Multiple choice questions

- True/false questions

- Short answer questions

- Essay questions

The multiple choice and true/false questions test candidates’ knowledge of tax laws and regulations. The short answer and essay questions assess candidates’ ability to apply tax concepts to specific situations.Overall, the H&R Block Tax Assessment Test is a comprehensive and challenging assessment of candidates’ tax knowledge and skills.

The test is designed to identify candidates who have a strong understanding of tax laws and regulations and who are able to apply them to real-world scenarios.

Preparation Strategies

Thorough preparation is crucial for success on the H&R Block Tax Assessment Test. Effective study methods, time management strategies, and practice tests can significantly enhance your performance.

Effective Study Methods

- Review the Test Blueprint:Familiarize yourself with the test’s structure, content areas, and time limits.

- Study Tax Concepts:Focus on understanding the fundamentals of taxation, including income, deductions, credits, and filing requirements.

- Practice Problem-Solving:Engage in practice problems to develop your ability to apply tax principles to real-world scenarios.

- Use Study Materials:Utilize H&R Block’s official study guide, practice questions, and online resources.

- Join Study Groups:Collaborate with peers to discuss concepts, share knowledge, and clarify doubts.

Time Management and Test-Taking Strategies

- Manage Time Effectively:Divide the allotted time strategically, allocating more time to challenging sections.

- Read Instructions Carefully:Ensure you fully understand the question before attempting to answer.

- Eliminate Obvious Incorrect Answers:Focus on eliminating incorrect options first, narrowing down your choices.

- Use Logic and Deduction:Apply logical reasoning and deduction skills to determine the correct answers.

- Guess Intelligently:If you are unsure, make an educated guess based on the available information.

Benefits of Practice Tests, H&r block tax assessment test answers

- Assess Your Knowledge:Practice tests provide a valuable assessment of your understanding of tax concepts.

- Identify Weaknesses:They help you pinpoint areas where you need additional study and improvement.

- Simulate Test Conditions:Practice tests mimic the actual test environment, building your confidence and reducing test anxiety.

- Improve Time Management:By taking timed practice tests, you can refine your time management strategies.

- Boost Confidence:Successful performance on practice tests can boost your confidence and motivation.

Assessment of Test Results: H&r Block Tax Assessment Test Answers

The H&R Block Tax Assessment Test is scored on a scale of 0 to 100, with higher scores indicating a stronger understanding of tax concepts and principles. The test results are typically divided into four categories: strengths, weaknesses, opportunities, and threats.

Understanding your strengths and weaknesses can help you focus your preparation for future tax assessments. For example, if you scored well on the section covering individual income tax, you may want to focus on brushing up on your knowledge of business tax.

Scoring System

- 0-25: Poor

- 26-50: Fair

- 51-75: Good

- 76-100: Excellent

Interpreting Results

Your test results will provide you with a detailed breakdown of your performance in each section of the test. This information can be used to identify areas where you need to improve your knowledge and skills.

Improving Future Performance

If you are not satisfied with your test results, there are a number of things you can do to improve your performance on future tax assessments.

- Review the test results carefully and identify your strengths and weaknesses.

- Develop a study plan that focuses on improving your knowledge in the areas where you need the most help.

- Take practice tests to get a feel for the format and content of the actual test.

- Consider taking a tax preparation course or working with a tax professional to get additional help.

Utilizing the Test for Career Advancement

The H&R Block Tax Assessment Test is a valuable tool for career advancement in the tax industry. By demonstrating your knowledge and skills in taxation, you can increase your competitiveness in the job market and enhance your chances of securing your desired position.

Job Applications

When applying for tax-related jobs, employers often use the H&R Block Tax Assessment Test to assess candidates’ qualifications. By providing a strong performance on the test, you can demonstrate your proficiency in taxation and set yourself apart from other applicants.

The test results can serve as tangible evidence of your knowledge and abilities, making your application more compelling.

Interviews

During job interviews, the H&R Block Tax Assessment Test can provide you with confidence and credibility. By discussing your performance on the test, you can highlight your strengths and demonstrate your commitment to the field of taxation. Additionally, the test can provide a framework for discussing your tax-related experiences and skills, making you appear knowledgeable and prepared.

Success Stories

Numerous individuals have benefited from taking the H&R Block Tax Assessment Test. For example, one candidate, who had recently graduated with a degree in accounting, was able to secure a tax associate position at a reputable firm after scoring well on the test.

Another candidate, who had been working in the tax industry for several years, used the test to advance to a senior tax accountant position. These success stories demonstrate the value of the test in the job market.

Frequently Asked Questions

What is the purpose of the H&R Block Tax Assessment Test?

The H&R Block Tax Assessment Test is designed to evaluate an individual’s knowledge and skills in tax preparation, ensuring that they possess the necessary foundation to excel in this field.

What is the format of the test?

The test typically consists of multiple-choice questions covering a range of tax-related topics, including individual and business taxation, tax laws, and accounting principles.

How can I prepare effectively for the test?

Effective preparation involves studying the relevant tax codes and regulations, practicing with sample questions, and seeking guidance from experienced tax professionals or online resources.

How are the test results interpreted?

The test results provide a comprehensive assessment of an individual’s strengths and weaknesses in tax preparation, enabling them to identify areas for improvement and further development.